|

Cheapest States to Retire In – You Have Some Great Options

When thinking about the cheapest states to retire in, there are several factors to keep in mind. There isn’t necessarily a correlation between the most tax friendly states and the lower cost of living states. Your own personal tax obligations may vary slightly leaving the cost of living indicators carrying more weight in your decision. Tax ConsiderationsWhen looking for the cheapest states to retire in, you have several factors to consider. The first expense that most people think about is taxes. As a retiree you have several tax categories to consider:

Your overall tax burden will vary greatly by state but keep in mind that most states are scrambling for revenue. Any low or no tax state could change at some point. Your federal tax obligations will be the same no matter where you live. The taxes discussed here pertain to your state taxes only. Although the six tax categories can easily define the least expensive state, some states are extremely lenient with allowable deductions when you itemize. This will not only reduce your state tax liability but your federal taxes could also be less. You need to determine which is cheaper for you: to not have any sales tax or you’re your social security benefits to not be taxed. The following states are the most tax-friendly:

As you look at the table to determine the cheapest states to retire in from a tax perspective, the states ranking:

Cost of Living Breakdown

Once you’ve looked at your state tax burden, you now want to compare the cost of living and other factors to determine the best states to retire in. Keep in mind the cost of living index is 100. The list below represents those states with the lowest cost of living index starting with the lowest:

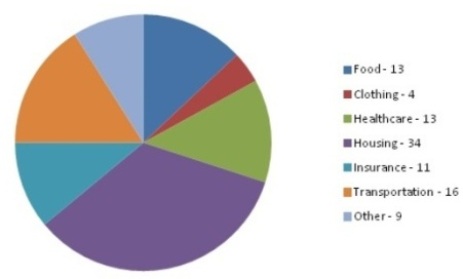

In case you’re interest the five highest cost of living states are: New Jersey at 126.5; Alaska at 126.4; Maryland at 125.8; Connecticut at 125.3 and Massachusetts at 123.3. The breakdown of the cost of living expenses: As you prepare for retiring and are choosing between the cheapest states to retire in, you’ll have to decide if you want to rent or buy. Make a list of the expenses for each and compare with your monthly budget. You want to include: the monthly rent or mortgage; insurance; property taxes; association dues; maintenance; and utilities. You also want to consider who you want to take care of the property, you or pay someone else. Using the states with the lowest cost of living index, the price of milk, bread and eggs compared to the national average:

Continuing with cost of living comparisons for choosing between the cheapest states to retire in, you might want to also take into consideration, the state’s percentage of the population that is homeless. This percentage will tell you a great deal about the state, how the economy is and what type of resources are available to those without a home/employment. Using the same states as the lowest cost of living states, the percentage of homeless is:

The national average is 0.21%. The highest percentage of homeless are: 1.05% in the District of Columbus; 0.54% in Nevada; and 0.45% in Oregon. The Cheapest States to Retire InWith all of this data, there are a couple of states with the least amount of state tax obligations; a low cost of living, proved by the cost of milk, bread, and eggs; and the percentage of the homeless population by state. Although Alaska favored well from a tax perspective, it is not one of the cheapest states to retire in. The top five contenders for the cheapest states to retire in are:

Each of these states has a lower cost of living; in fact the example of the cost of milk, bread, and eggs proved this number. All five states are in the south, with Kentucky the furthest north. Oklahoma was ranked sixth, in case you prefer to not live in the south. The overall state of the cheapest states to retire in is Mississippi. Mississippi is pension friendly, Social Security benefits are not taxed; it is a tax friendly state and one of the lowest median real estate taxes. It has the seventh lowest cost of living rate with a quart of milk costing $1.06, a loaf of fresh bread is $2.28 and a carton of eggs is $1.79.As if these financial reasons aren’t enough to be the champion of the cheapest states to retire in, Mississippi has the lowest percentage of homeless in the country. Alabama is a close second with tax advantages, a low cost of living and also a low homeless population. If you prefer Oklahoma, this state does not have any tax advantages but has the number one lowest cost of living in the country and have a fairly low homeless rate. Return from Cheapest States to Retire In to The Best Places to Retire Home Page |